Ever since crypto has become a global phenomenon, there has been a growing number of crypto scams due to their potential for high returns driven by their volatile nature. What seemed like a sound investment yesterday can easily turn your investment into a nightmare scenario overnight. You can be fooled in multiple ways, including fake exchanges, fake wallets, malware infiltrating your crypto wallets, or fake blackmail schemes. So, what happens if you’re indeed scammed? And, more importantly, can you recover crypto from a scammer? No, crypto transactions are irreversible and can't be canceled once sent. However, since crypto operates on a public blockchain, you can track your crypto, and if you find that your crypto was sent to a centralized exchange, you can report it to the exchange, which may freeze the scammer's account. If the scammer hasn’t yet withdrawn the funds, there’s a chance you could recover your crypto, especially if authorities investigate the case and order a refund. However, skilled scammers often use mixers and other privacy tools to obscure the transaction trail, making it impossible to trace the crypto. We compiled the best avoidance tactics, some of the most infamous scams, and a number of sites and fake exchanges you should avoid.

Can I Recover Money From A Crypto Scammer? The Harsh Reality & Two Use Cases

If you’re reading this because you lost some of your assets on a dodgy exchange or someone ran away with your investments, your first question is probably: can I recover money from a crypto scammer? No, because scammers can use mixers and other privacy tools to obscure the crypto's transaction history, making it difficult to trace. However, since blockchain data is public, you can track your crypto up to a certain point. If it ends up in a centralized exchange wallet, you can contact the exchange to freeze the scammer's account, and with the help of authorities, you may be able to recover your crypto. Although we at PlasBit think that once you’re scammed, there’s little to do and your assets are probably gone for good, the story of an elderly Houston resident shows there’s a silver lining. Here’s how the scam with a happy ending played out:

- Scammers contacted the victim on Facebook to join an investment group on WhatsApp.

- In this group, scammers posed as successful investors, sharing fake screenshots with non-existent profits.

- Scammers then pressured the victim to transfer money to several wallets, promising massive returns.

- The victim deposited $26,000, and the scammers showed falsified gains on a fake exchange site.

- Encouraged by his “wins”, the victim invested over $1 million.

- When the victim wanted to withdraw funds, the scammers denied his request. They said they couldn’t comply due to taxes and processing fees - also a typical tactic to prolong a scam.

- After realizing the fraud, the victim reported the crime to authorities.

- Using blockchain intelligence tools like TRM Labs, police could trace the movement of the funds right away. It turned out that the stolen ETH was transferred through several addresses before arriving at three separate wallets at the same exchange.

- Police officially requested the crypto exchange to freeze all assets in those wallets.

- After freezing ETH worth over $300,000, police could prove that at least $150,000 was from the victim’s assets.

- Although the majority of the $1 million was lost, recovering at least a portion of it is a huge win, especially considering how hopeless recovery can be.

Once they get their hands on your funds, it's highly unlikely you'll get any of your assets back

Use Case: Losing $210,000 For Good

If you think you’re immune to spammy pop-ups on dodgy websites, think twice. Some of the most lucrative scams start with the simplest and most well-known hooks. The scheme is quite straightforward:

- The victim clicks on a social ad or banner that promotes a surefire crypto investment.

- The victim is then contacted by a fake company, impersonated by the scammers.

- Scammers ask for a small investment. Once the victim transfers a few hundred dollars, they start seeing massive returns. It’s all fake, of course: cleverly built software shows rising charts, growing returns, and a wallet filled with a lot of money.

- When the victim tries to cash out, there’s always a (fake) hiccup: it can be a broker’s fee, a random tax, or some made-up regulation. The fake platform is displaying massive gains, so the victim is incentivized to pay these fake fees that stack up over time, and victims usually end up coughing up much more than they originally intended. The trick is that they could stop at any point, but they don’t: seeing how much they have already invested and how much they could get if they make this additional payment clouds their judgment. This is the essence of a pig butchering scheme: fake blockers, fake hope, fake gains, and painfully real losses.

- This goes on until the victim’s savings are stripped entirely.

Derek, a 69-year-old pensioner, lost over $200,000 while believing he had become a multimillionaire. He kept investing more - and kept using money that he didn’t own. He borrowed money from his brother and his son and even took out bank loans to finally access the perceived gains from his investments. Okay, but how is this possible? Do you really just click on a spammy ad, then chat with someone from a fake company, and then start burning all the cash you (don’t) have? Well, Derek had 331 calls lasting 135 hours with the fake sales rep. As he reminisces, “Every time you challenged the financial rep, he’d say something that made you think you’d been daft asking a question”. These scams work because they get under your skin. For days and weeks, you keep talking to someone who convinces you that you’re making a ton of money, and then the world starts to look different. Derek has recovered around $22,000, which was barely enough to pay off his bank loans. So, can you recover crypto from a scammer in Derek’s case? His refund claim is currently with the Financial Ombudsman, and his son is living with him rent-free to at least reduce some of his debts until he can recover some of his lost funds.

Crypto Scammers List: A Compilation You Don’t Want To Belong

The crypto world is a hotbed for scammers, and it’s impossible to keep track of all of them. Still, we put together a crypto scammers list of exchange websites that are known to be crypto scams, updated to 2025 - Fake Brave Crypto Wallet (impersonating Brave Software) - bravehqnx.cc, Capital handels system - capitalhandelssystem.com, ABS Trading - absgbl.com, Top kex - topkex.com, Effortsity - effortsity.com, cipherxpro.com, Rolly Invest Group - rollysolution.com. If you have any doubts, here’s a detailed breakdown of why you should totally avoid them:

- Brave Crypto Wallet Impersonator (bravehqnx.cc). This site imitates the otherwise legit Brave browser. Many flagged it for promoting fake crypto giveaways using deepfake celebrity videos. Some deposited funds and could never recover them - now, the California Department of Financial Protection and Innovation reported it as unregulated and suspicious.

- Capital handels system (capitalhandelssystem.com). Offering exclusive investment opportunities with zero regulatory oversight should scream scam for anyone. It masks this lack of transparency by saying that it’s a “private transaction” exempt from US laws.

- ABS Trading (absgbl.com). Users often complain about not being able to withdraw funds and the platform demanding additional payments to release funds. ScamDoc gives the site a trust score of 1%.

- Top kex (topkex.com). Ah, romance-based scams: the victim is looking for love, fails to find it, and then even gets scammed. Fake profits, blocked withdrawals, funds syphoned without a trace: PlasBit says you should totally avoid them.

- Effortsity (effortsity.com). Redditors identified it as a scam: investors couldn’t access their funds and were often asked to deposit even more money to withdraw anything.

- Cipherxpro (cipherxpro.com). A lack of transparency, negative reviews, no credible endorsements, and an unregulated status spell “Proceed with caution”. Perhaps even better, “do no proceed at all”.

- Rolly Invest Group (rollysolution.com). Another unregulated platform, Rolly Invest Group users complained that they couldn’t access their funds. Although some trust sites do not completely downgrade the platform, we’d suggest steering clear.

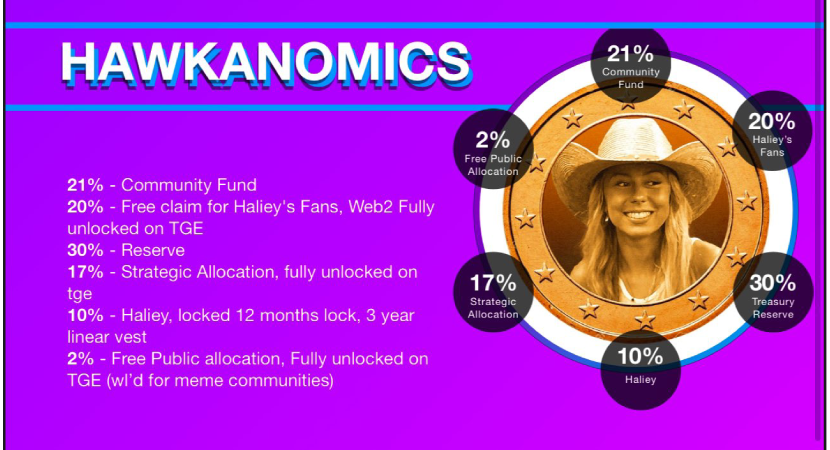

But can you recover crypto from a scammer if they are celebrities? While Hailey Welch is not on our list (yet), her memecoin HAWK is another reminder that scams can happen in broad daylight. Not all scams happen in the darkest corners of Web3, so watch out for celebrity-driven hype, as it can often end up badly for investors.

$HAWK is yet another dodgy memecoin that is borderline scammy

Scammers Behind Bars

While most lost funds are lost for good, sometimes law enforcers stumble upon a colossal amount of stolen assets. Enter Ilya Lichtenstein and Heather Morgan, the married couple you’ve never heard of but who somehow managed to get away with a jaw-dropping $4.5 billion. Yes, with a “b”. If you’ve been investing in crypto for a while, you might remember that BTC’s value dropped in 2016 by 20% within hours. In August 2016, Hong Kong-based crypto exchange Bitfinex announced that it had suffered a security breach. Around 2,000 transactions were transferred to a single wallet, causing chaos amongst wallet holders directly and indirectly affected by the hack. BTC’s value shook, and Bitfinex halted withdrawals and trading. It took Bitfinex 7 years of joint work with the Department of Homeland Security to recover around $315,000 stolen in the 2016 breach.

Posing like you just stole over $4 billion worth of crypto funds

Jumping back to post-breach days, the stolen funds from Bitfinex started their never-ending journey on the road of money laundering. From a single wallet, the entire sum was transferred to Dark Web marketplace AlphaBay, but then it was quickly moved Russian marketplace Hydra as the FBI cracked down on AlphaBay. Although we can’t say it for sure, the feds might have gotten crucial info about the identity of the thieves at this time. Anyway, the funds were then transferred to traditional bank accounts and spent on gold; NFTs, Uber rides, and PlayStations were purchased with it. Although millions were converted into fiat currency, the majority (80%) of the BTC (around 94,000) remained in the original wallet. Upon their arrest, Lichtenstein and Morgan pleaded guilty to money laundering and to conspiring to defraud the United States. Lichtenstein was sentenced to 60 months in prison and three years of supervised release, while his wife was sentenced to 18 months and a similar, 3-year supervised release. So, can you recover crypto from a scammer like Lichtenstein and Morgan? The seizure is the biggest in USA history: the DoJ says that it has recovered $3.6 billion out of the $4.5 billion the couple laundered. While behind bars, the internet is having quite some fun with digging up new pieces from the couple's past - our favorite one at PlasBit has to be Morgan’s article on Forbes titled “Experts Share Tips To Protect Your Business From Cybercriminals”.

Imagine getting away with over $4 billion and, in 4 years, writing about cybercriminals for Forbes

Spotting Scammy Websites And Tips To Avoid Them

Scam websites come in many shapes and forms, but it's relatively easy to dodge the bullet if you know what to watch out for. A well-built site will look totally legit: it can be a tech support page, a crypto exchange, an online store, and so on. The point is that you get the impression of a real business, while its only real purpose is actually stealing your money, personal data, or sensitive details like credit card numbers or crypto wallet information. To spot any site like this, watch out for the following:

- Typosquatting. Check for suspicious domain names with misspellings (e.g., amazen.com), extra characters (amazon1.com), or unusual extensions (amazon.aaa). We often fall victim to this incredibly simple tactic: we are so used to visiting amazon.com that we won’t even glance at the address bar. Once you’re fooled, the website will look just like the real one, and you won’t have the chance to spot the difference.

Slight variations of well-known domains screams scam

- No encryption. https:// is pretty much the golden standard for website security, and most browsers come with integrated functionalities to warn you before you’d enter a page without such protocols. You’d better make sure that the website you’re visiting has the https:// protocol before sharing sensitive information. Still, it can’t make 100% sure you’re on the safe side.

- Zero reviews. Or dodgy ones. Fake sites usually have fake/paid reviews. Browse relevant communities and forums, and look for real people with real experiences about the site.

- Pushy promos. Trustworthy sites don’t want to get in your face with can’t-miss deals. Suspicious ones do, so if you see something like “Limited offer: 1 BTC for 1 USD”, you need to backpedal.

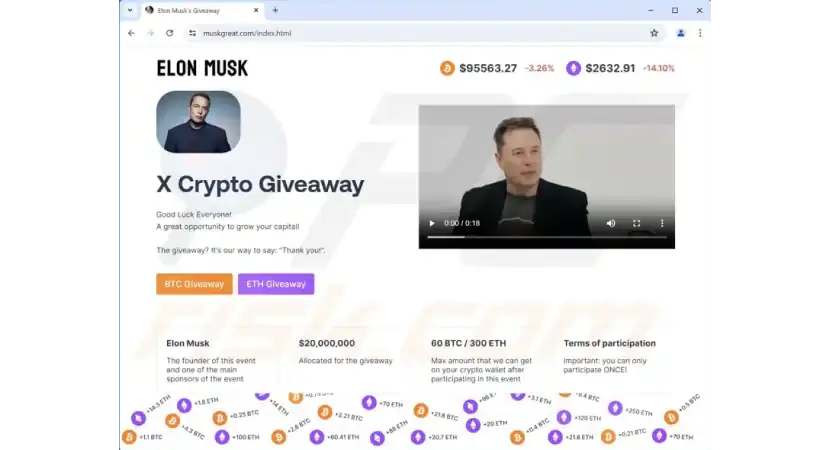

If using Musk to boost your site's credibility isn't a red flag, "BTC/ETH giveaway" buttons definitely are

- Overall look. Spend some time on the website. Just by looking at it thoroughly, you’ll start noticing weird stuff: typos, poor design choices, unrealistic offers, and hard-to-find (or non-existent) contact information all scream “scam”.

- Regulation matters. Check for regulatory body approvals. If the site is not registered with financial authorities like the SEC or FCA, you should forget about it immediately.

- Use spam detectors. SpamDoctor and VirusTotal are great for giving an overall feel of any website. Risk and reputation scores help you decide if you should keep digging or abandon your research.

- Spammy pop-ups. If you arrived at the site via a dodgy pop-up from somewhere else, think twice. Legit businesses won’t advertize while you’re trying to p2p stream baseball on a dodgy site.

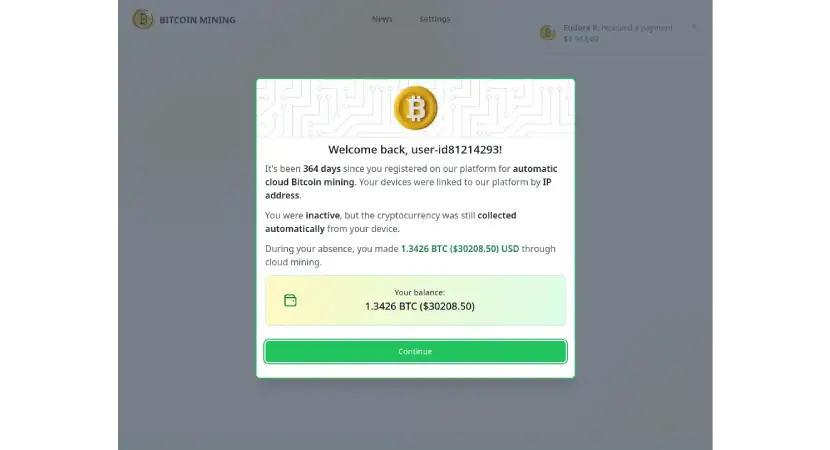

Everyone dreams of BTC just being generated with zero effort - however, it's a sure sign of a scam

The single best advice we can give you at PlasBit is to double- and even triple-check. Spending a few extra hours just to go through public reviews, dig up certificates and credentials, and read through the website itself is really not a huge sacrifice. Especially if you are about to make a major investment that affects much of your savings.

Fake Crypto Exchanges: Buyers Beware

Okay, we already picked the worst scammy sites, and now it’s time to show you the crypto exchanges you should avoid. This is a list of fake crypto exchanges websites, updated to 2025 - fpmarkets impersonators - https://fp-markets.net/, ICT Chartist - lzfu.com, Spark RLV - www.sparkrlv.com, Pne coin - www.pnecoin.com Newton Portfolio (Newton Crypto impersonators) - http://www.Nportfolio.com. And this is why you should avoid them:

- Fpmarkets impersonators (e.g., fp-markets.net). Duplicates of the legit FP Markets are lookalikes that try to trick you into depositing funds and then get away with your money.

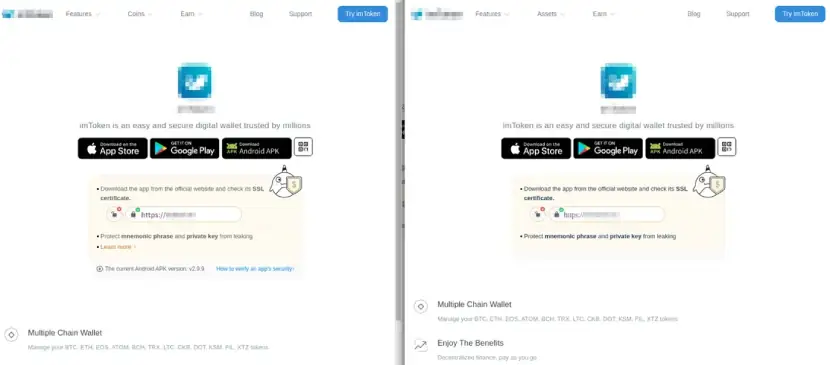

Clone sites are often almost identical duplicates of the original

- ICT Chartist (izfu.com). Previously known as PKFX, ICT Chartist’s name change is due to the government being after their founder. Not a good sign. It’s been listed as a scammy site on most detector pages, with many users reporting fraudulent activities.

- Spark RLV (sparkrlv.com). A new site domain and hidden owner identity are a recipe for scams. Being listed as part of the most common crypto scams is not a good sign, either.

- Pne coin (pncecoin.com). No whitepapers, no details on the dev team, Pne coin is linked with pig butchering scams. Stay away from them.

A well-built scam site will use recognizable and professional design language to fool you

- Newton Crypto impersonators (Nportfolio.com). A go-to crypto exchange in Canada, Newton Crypto has many doppelgangers. Just like in the case of Fpmarket scams, thieves will do everything to re-create the trustworthy crypto exchange site, only to steal your assets.

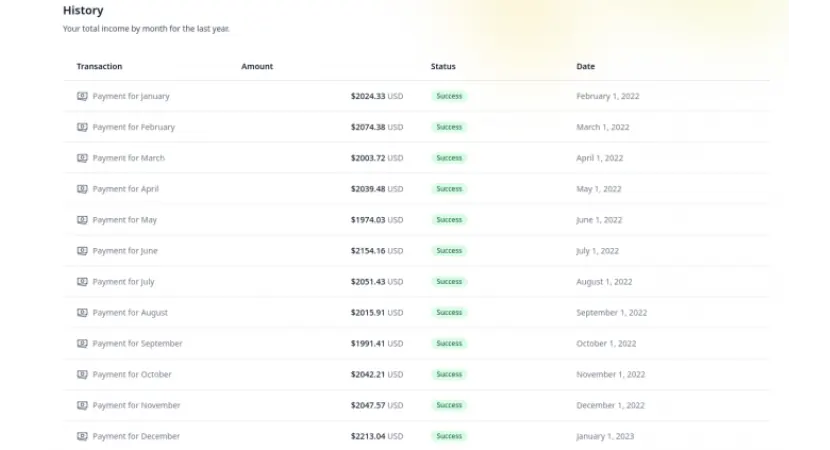

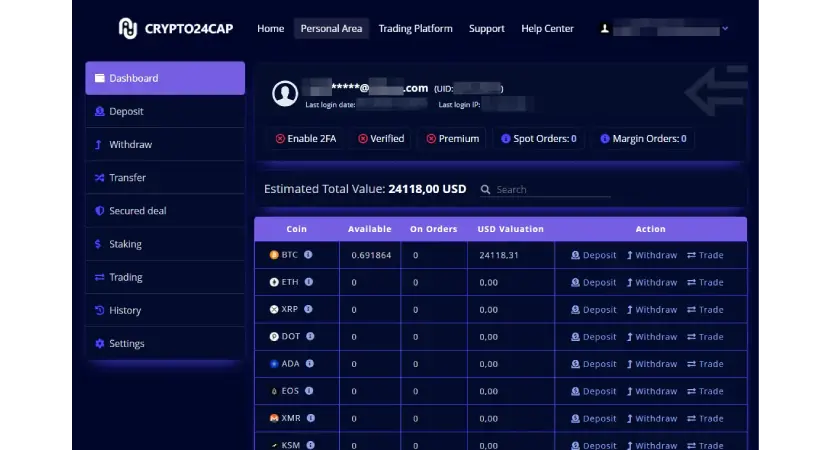

Crypto24cap is now down, but it demonstrates how legit these scam sites can seem at a glance

Always look for credible crypto exchanges. Most currencies are traded on renowned exchanges, so you’ll find plenty of information and verification, plus credentials even if you Google for just a few minutes.

Recovery Isn’t Possible, Prevention Is

So, can you recover crypto from a scammer? As the title suggests, once the damage is done, it’s incredibly unlikely that you can recover any of your crypto assets. To avoid being scammed out of your crypto, you need to do your research: make sure there’s real time behind the platform or website where you plan to invest, check for trust scores and reviews by real human beings, look for whitepapers, and rule out any possibility of a scam. If the alarm bell goes off during your research, it’s safe to steer clear. You might have to spend more time finding the goose laying golden eggs, but your assets will stay safe, and you’ll rest assured your investment is not exposed to scammers.