If you find yourself asking the question, How do I sell Bitcoin in Belgium? You need to first deposit bitcoin into your exchange wallet, go to the ‘Wires’ section, select Euro as the currency, and after you submit the request the funds will be credited to your bank account, usually on the same day. It’s important to note that before you submit the request, you must complete a full KYC process that includes verifying both your identity and your address to ensure regulatory compliance. Also, the wire transfer request will be rejected in the following cases: the name on your bank account and your PlasBit account are mismatched, or if you are trying to transfer to a third-party account.

Learn how to use the PlasBit Bank Wire Feature below.

How to Use the Bank Wire Feature on PlasBit

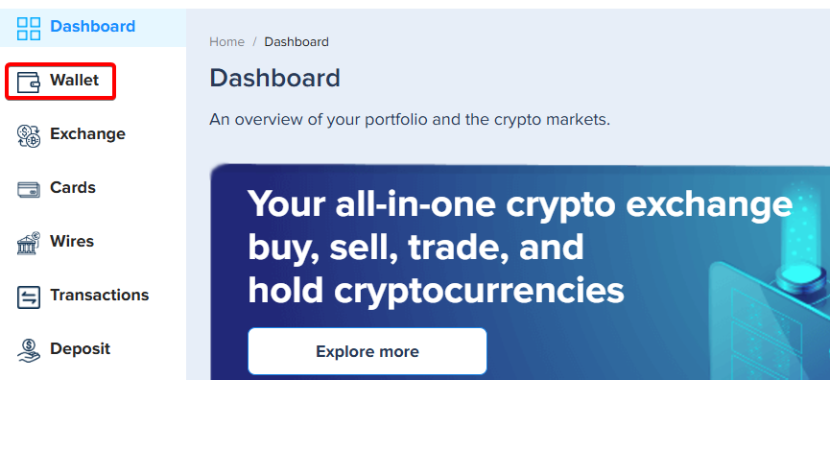

1. Log in to your PlasBit account and click on the [Wallet] tab in the upper left corner.

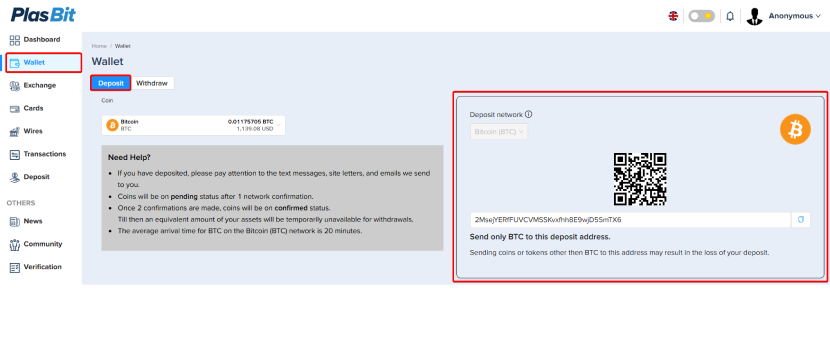

2. Now press Deposit, and deposit Bitcoin into your PlasBit wallet. The wallet address is on your right, or you can use the QR code.

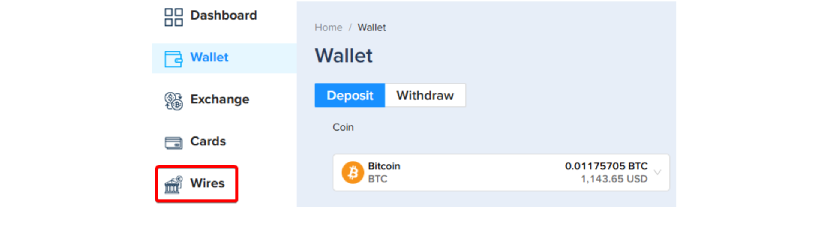

3. When the Bitcoin has been deposited, navigate to the [Wire] tab on the dashboard.

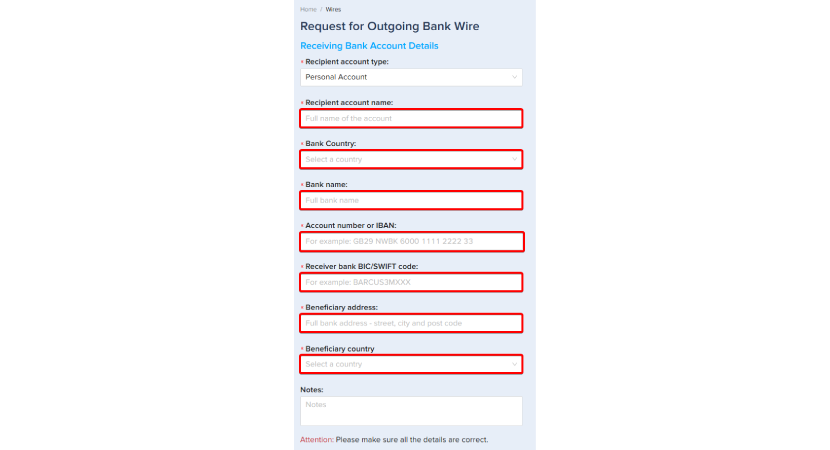

4. Next, you will need to fill in the bank details for the wire. Please note that the name of the bank account holder and the PlasBit account needs to be the same.

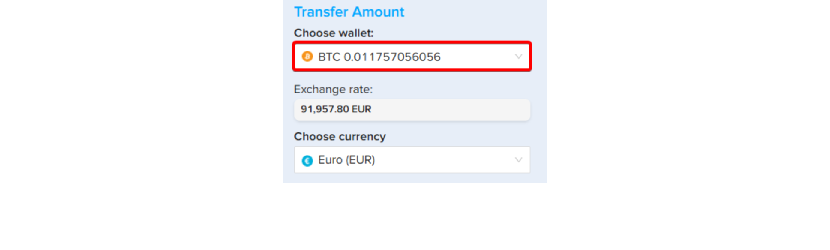

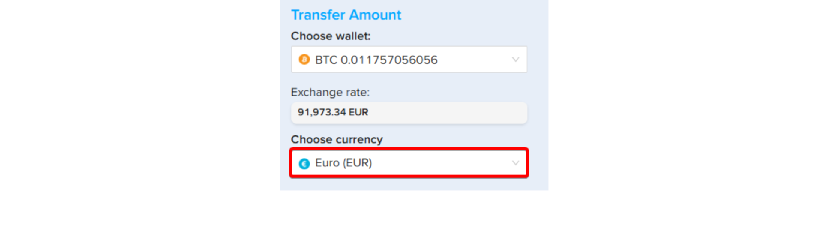

5. After filling in the bank details, you need to specify the wallet from which the funds should be withdrawn. Choose the wallet where you have just deposited your Bitcoins.

6. You can choose the currency, in this case, EURO, and see the exchange rate.

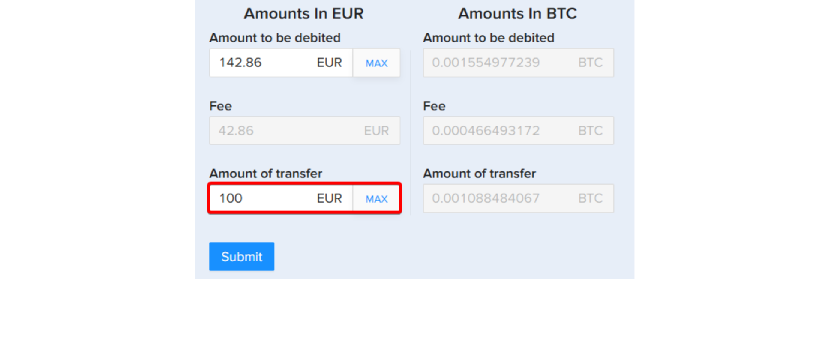

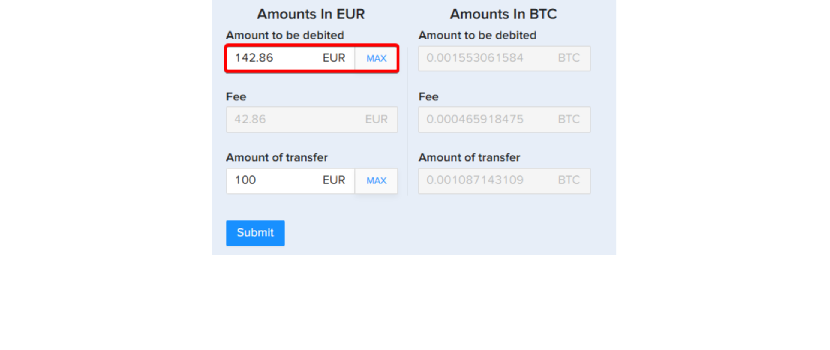

7. Fill in the Amount of transfer field with the exact amount you want to receive in your bank account; all the fees will be automatically added and debited from your wallet.

Alternatively, you can fill in the Amount to be debited field, which is the total amount that will be deducted together with the fees from your wallet. The amount you receive in your bank account will be this amount minus the fees.

Now, just press [Submit].

* Note: To be able to do the wire transfer, you will have to complete the identity verification. If you haven’t done so, you won’t have the option to press submit.

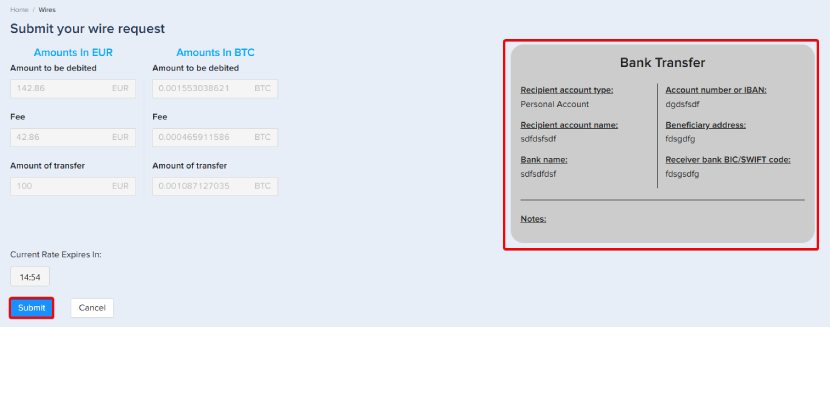

8. Carefully check all the details of the Bank Transfer and press [Submit] again.

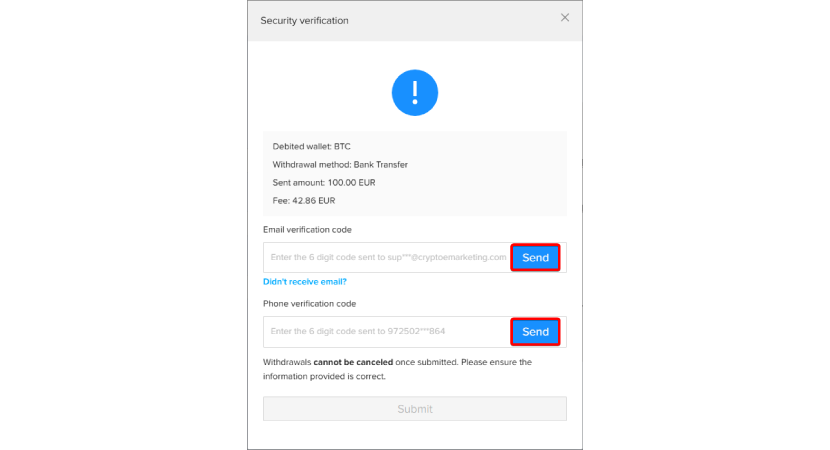

9. Now, you will need to go through the security verification. Please press [Send] to receive verification codes on your email and phone.

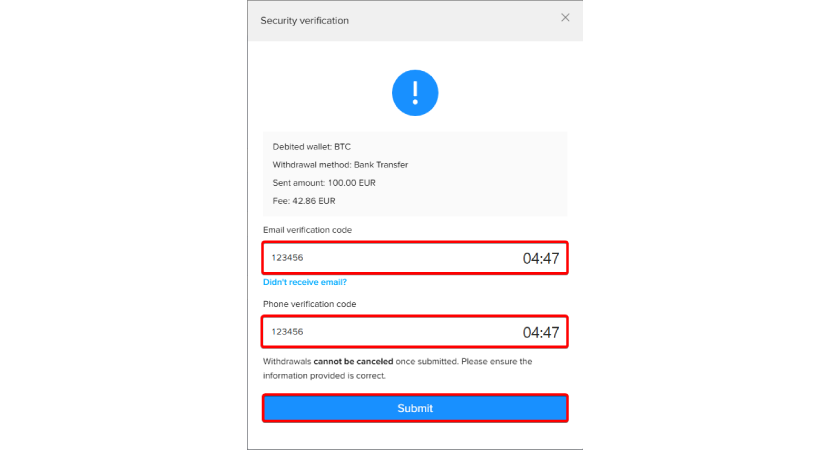

10. Copy and paste both verification codes after receiving them and click [Submit] to finish. You have 5 minutes before the codes expire.

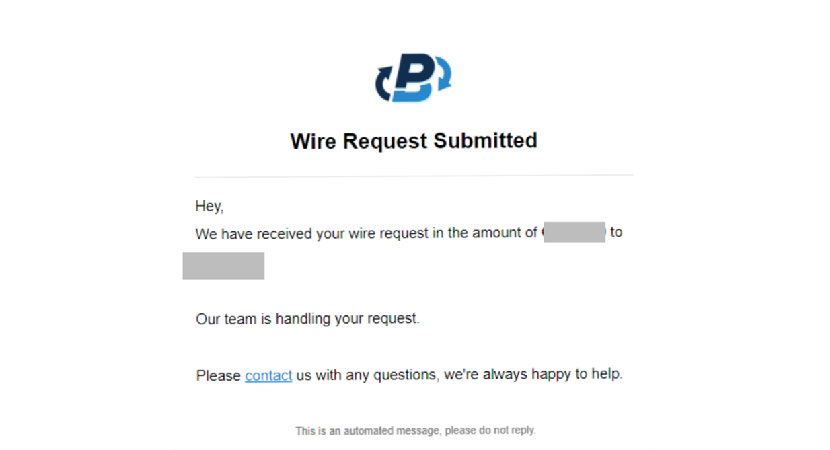

11. After this, you will be automatically redirected to the dashboard and will also receive an email verifying “Wire Request Submitted.”

After we approve the request, you will receive another email, “Wire Request Approved.”

The transfer of funds usually takes 0 to 5 days.

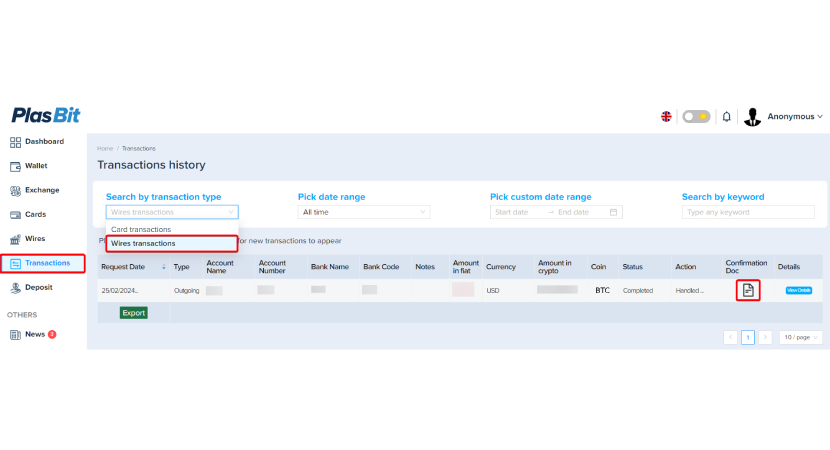

12. In the [Transactions] section, if you select [Wires transaction] from the drop-down menu, you will be able to see the status of your transfer, and after the transaction is approved, you’ll be able to download the transaction details in PDF.

Crypto Regulations and Taxes in Belgium

While cryptocurrency is widely unregulated around the globe, each country treats the profit made from crypto trading and mining differently. Here are the things to keep in mind when selling crypto in Belgium.

Cryptocurrency Remains Largely Unregulated in Belgium

Much like other nations cryptocurrency remains widely unregulated in Belgium. The country does not recognize cryptocurrencies like Bitcoin and Ethereum as legal tender and has no general regulatory framework for digital assets.

In Belgium, the advanced decision service Oregon SDA has determined that cryptocurrencies are classified as speculative investments and therefore are treated as miscellaneous income. When it comes to tax laws around cryptocurrencies, Belgium treats digital assets differently based on the individual and how they choose to invest. Most individual investors have their cryptocurrency classified as speculative investments while businesses and professional crypto traders and miners have their digital assets classified as income.

Communal Taxes in Belgium

Belgium imposes a communal tax based on the municipality that you live in. This Communal tax can vary anywhere between 0%-9% depending on where you live. Depending on the municipality you live in, you could be paying a significantly higher tax rate on the income gained from selling Bitcoin in Belgium.

The communal tax is an additional tax imposed in addition to the flat rate of 33% on capital gains as well as the variable rate applied on income.

For example, someone living in Brussels will pay an additional 6% tax rate on top of the already variable income tax while someone living in Antwerp will pay 8%. Tournai boasts the highest communal tax rate at 8.8% while De Panne has a communal tax rate of zero.

Capital Gains Tax for Speculative Investments

Belgium usually does not implement a capital gains tax for individual investors, but in the case of capital gain acquired through the sale of Cryptocurrency, this is not the case. Because crypto is considered a speculative investment, any gains are taxed at a flat 33% rate. This is the national standard for all speculative investments and therefore applies to the sale of cryptocurrency as well. You will also be charged an additional communal tax ranging from zero to 9% depending on the municipality that you live in.

For most individual investors who buy and sell crypto in Belgium, the capital gain tax of 33% is unavoidable. However, in some special cases, individuals are not required to pay a capital gains tax if their profit is considered income from their profession.

Variable Professional Income Tax

While most hobby-investors and crypto enthusiasts will have to pay the 33% capital gains tax on their profits, there are some exceptions that allow individuals to forego a capital gains tax in place of an income tax. If you are a professional investor or make a profit from crypto mining you will not have to pay a capital gains tax because the profits from your crypto are not a capital gain from speculative investments, they are your income.

If you are a professional investor whose primary source of income comes from cryptocurrency trading or mining, you will be charged the Belgian variable income tax. This tax rate can vary anywhere between 25 and 50% and is dependent on your annual income.

In addition to the variable income tax that will be applied to your cryptocurrency gains, you will also be charged the communal tax of the municipality that you live in. You may also be forced to contribute to Social Security if your income reaches a certain level.

In most scenarios, professional investors will end up paying a much higher tax rate than someone simply using crypto as a speculative investment. However, if a company or business trades or mines cryptocurrency it will only be taxed at the corporate income tax of 25%

Bon père de famille – Prudent Investments

One of the more beneficial regulations in Belgium comes in handy when you are buying cryptocurrency as a long-term prudent investment. The Bon père de Famille makes cryptocurrency transactions tax-free as long as they are considered normal management of your private assets. Determining what constitutes normal management of your private assets is highly subjective and depends on everyone’s financial situation.

The Service Public Fédéral Finance or SPF determines whether an individual's investments in cryptocurrency fit the parameters of a prudent investment. The SPF will look at the amount of cryptocurrency that was purchased as well as the lengths that the individual intends to hold on to the investment. If a cryptocurrency purchase is not used as a speculative investment, the SPF will most likely determine that it is a prudent investment and therefore will not be taxed. If you are unsure how your investment will be viewed by the government, the SPF provides a simple questionnaire that will help you learn if your investment is considered prudent or simply a speculative investment intended to earn a capital gain.

Cryptocurrency Gift Tax

Another situation when cryptocurrency is taxed by the Belgian government is if it is given as a gift to a charitable organization. Cryptocurrency is treated like any other financial gift and therefore receives the same taxation.

The gift tax in Belgium varies based on the organization that receives the donation as well as who is donating. As of July 1st, 2021, all donations to registered charity organizations are taxed at a rate of 0%. This is because Belgium wants to encourage donations to charitable causes. If the donation is given to private foundations or professional associations the gift is taxed at a 5.5% rate. If the party donating to the charitable organization or foundation is also a foundation there's a flat rate of €100.

For cryptocurrency, the amount that is taxed can be determined by the simple equation below:

Value of the gift at the time of Donation – Value of the Gift at the time of Purchase = Taxable amount.

The Crypto Community is Bustling in Belgium

Blockchain Brussels

Blockchain Brussels is a community organization focused on discussing and exploring everything related to the blockchain. The group has a monthly event at the BrewDog Pub in Brussels where members watch movies, listen to a guest speaker, and join in on discussions about cryptocurrencies, NFTs, and everything to do with the blockchain. Blockchain Brussels is a great meet-up activity for those interested in learning more about crypto and sharing their thoughts with other like-minded individuals.

Belgian Bitcoin Embassy

The Belgian Bitcoin Embassy is both an online and in-person community with the goal of growing the Bitcoin ecosystem in Belgium. The group was founded by a couple of Bitcoin enthusiasts who are passionate about educating others about crypto. The group meets monthly to discuss the latest happenings in the world of crypto as well as their personal experiences trading and mining bitcoin. The meetups are open to anyone interested.

The Belgian Bitcoin Embassy also hosts an online community on their website. Here you can find a blog with up-to-date articles on the latest Bitcoin news around Belgium. The site also contains all the information you need to start buying and trading Bitcoin. For crypto enthusiasts, the Belgian Bitcoin embassy seems to be a great resource to meet like-minded individuals and learn more about Bitcoin in Belgium. At the very least, the Belgian Bitcoin Embassy has quite a collection of crypto-related memes that are sure to give you a laugh.

BEFire Subreddit

r/BEFire is an active subreddit with 44k members focused on the principles of Financially Independent/ Retire Early (FIRE). While the subreddit is not dedicated solely to crypto, there are many active conversations about how crypto can be used to reach financial freedom in Belgium. There is not a dedicated subreddit for crypto in Belgium so, many of the discussions about bitcoin in Belgium are held within this subreddit. Belgians are discussing where to buy and sell bitcoin in the country and where they can actively exchange or use their crypto as cash.

Cryptocurrency Adoption and Initiatives in Belgium

Belgium's history with cryptocurrency is similar to that of the rest of Europe. While plenty of blockchain and crypto enthusiasts have experimented with digital assets early on, a nationwide focus and national initiatives started to emerge as early as 2021. According to a national survey given in 2021, 9% of Belgians reported owning Bitcoin and that number has only grown. The cryptocurrency market in Belgium is projected to grow by 3.19% from 2024 to 2025.

When looking at how many people own Bitcoin in neighboring countries, more Belgians own Bitcoin than both Germany and the Netherlands. While the Belgian government still does not regulate cryptocurrency or digital assets there are plenty of interesting initiatives across the country that have promoted the use and exploration of cryptocurrencies in Belgium. Although the Belgian government is putting forth a valiant effort to grow the crypto community, the majority of the country’s innovations have come from private forces.

Crypto Regulations from Belgian-Backed EU

During the Crypto boom of 2020, the Belgian government began initiatives to warn citizens about the dangers of crypto scams. From those early days, government initiatives aimed at growing and supporting crypto have come and gone with little to show. Belgium’s major contribution to the world of crypto will most likely come during their current reign as the presidency of the Council of the European Union.

The Belgian-backed EU is looking to implement more crypto regulations while simultaneously growing Europeum, the EU blockchain initiative intended to make citizen data more secure and shareable between nations. During this initiative, the national government will also look at the possibility to grow digital currencies backed by the EU.

WalChain

One of the earliest and most influential initiatives in Belgium started in the Southern region of Wallonia in 2021. WalChain is a collection of local blockchain startups and cryptocurrency experts that helped expand support for local economies looking to explore blockchain technology and move into the world of digital assets. WalChain has helped Wallonia become a hub in Belgium for Crypto enthusiasts and entrepreneurs looking to scale their startups.

Blockchain4Belgium

In 2023 the Belgian national government launched the Blockchain4Belgium initiative. This initiative aimed to gather opinions and suggestions from those in the crypto community looking to have a stake in the future of cryptocurrencies and blockchain technology in Belgium. Blockchain4Belgium promised to support the national growth of Belgian fintech companies who wanted to help establish Belgium as a leader in blockchain technologies like cryptocurrency.

Belgian-Based Blockchain Companies

Belgium boasts a couple of innovative blockchain companies that have made real contributions to the global economy through the application of the blockchain. While these companies do not deal directly in cryptocurrency, the growth in public awareness of the blockchain has built trust in the Belgium crypto community.

SettleMint, founded in 2016, was one of the first Belgian companies to innovate with blockchain technology. SettleMint provides a pre-built infrastructure for other businesses to use blockchain technology.

T-Mining, founded in 2016, uses blockchain technology to track and manage shipping containers. T-mining is responsible for a severe decline in the number of shipping containers misplaced or stolen each year.

Crypto In The News

Recovery Room Fraud on the Rise

In recent news, Belgium has seen an uptick in "Recovery Room Fraud" affecting citizen's crypto-wallets. “Recovery Room Scams” are fraudulent activities that target individuals who have already been victimized by financial fraud. These scammers promise to help victims bounce back from their misfortune only to charge an upfront fee and regain access to their crypto wallets for continued theft.

The Financial Services and Markets Authority identified fraudulent activity and potential recovery room scams from the following organizations: Akin, Bitcity, Concord Services, Legible, Recovery AI, Trade Control, and World Blockchain Organization.

Belgian-Backed EU Implements Crypto Regulations

As Belgium assumes the presidency of the Council of the European Union national leadership has shared plans to create further regulations and allocate more resources around cryptocurrency. Belgian leadership has stated their plans to reboot the European Blockchain Services Infrastructure in hopes of developing more accurate and effective regulations around the blockchain throughout the European Union. The new infrastructure, to be named Europium, does not directly address cryptocurrency but rather looks to use the blockchain to consolidate citizen data across the entire EU.

This digital infrastructure has the potential to develop a greater understanding of crypto assets while incentivizing collaboration on a blockchain network across the continent. The initiative also looks to support future digital currencies and their applications for both citizens and businesses throughout the EU.

Using Crypto in Belgium

Cryptocurrency is growing in popularity across Belgium and is becoming an accepted form of payment at many day-to-day establishments. Much like other nations, Cryptocurrency is more widely accepted in Belgium's larger cities like Brussels, Antwerp, and Ghent. Here are a few places where you can use cryptocurrency to pay for your goods and services in Belgium.

Cafes and Restaurants

While there are many cafes and restaurants across Belgium that accept crypto payments, most businesses accepting crypto can be found in Brussels, Antwerp, and Ghent. Here are some options:

- Thaiburi in Brussels

- BÚN Bar & Restaurant in Antwerp

- The Ribhouse in Ghent

- Osteria Romana in Brussels

Other Methods for Selling Bitcoin in Belgium

While bank transfers are a simple way to sell your Bitcoin for Fiat in Belgium, there are a few alternative ways for you to use your Bitcoin throughout the country.

Bitcoin ATMS in Belgium

As of 2020, there were 13 confirmed Bitcoin ATMs across Belgium with five locations in Brussels, Four in Antwerp, and a few scattered across the rest of the country. In recent years, many of those ATMs have disappeared in lieu of easier and cheaper methods to exchange Bitcoin for fiat. While a few Bitcoin ATMs around the major cities, they are not as widely accessible as they are in other nations.

Bitcoin ATMs exchange the cryptocurrency in your digital wallet for legal tender. These machines often feature high fees and low withdrawal limits. While a Bitcoin ATM can be convenient based on location, there are more efficient ways to sell your Bitcoin for fiat in Belgium.

PlasBit Debit Card

When it is not convenient to convert your Crypto to fiat using PlasBit’s bank wire service, you can always use the PlasBit debit card to make your purchases.

Getting your PlasBit card is simple and only requires a few steps. Once you have Bitcoin moved into your PlasBit wallet, you can order your safe and secure PlasBit debit card. The PlasBit debit card can be used as a traditional debit card in establishments that do not accept cryptocurrency outright.

The PlasBit card is easier and cheaper to use than Bitcoin ATMs and allows you to make purchases directly at retailers without an additional stop. The high limits make it an easy way to get the most out of your crypto. With a $10,000 daily withdrawal limit and a $30,000 purchase limit, the PlasBit debit card is a simple way to use your Bitcoin to make all your purchases in Belgium.

Selling Bitcoin in Belgium is possible with the help of our bank wire and card services.

When it comes to the question, “How do I sell Bitcoin in Belgium?” There is no easier, safer, or cheaper way than by using the Plasbit bank wire service. Plasbit makes it easy to convert your Bitcoin into fiat quickly and safely. With SMS verification support, using your PlasBit wallet has never been easier in Belgium. You can also use your PlasBit debit card for purchases in Belgian establishments that do not accept Bitcoin. Hopefully, this guide has given you all of the information you need to use your Bitcoin in Belgium as an expert. Remember to stay mindful of Belgium’s tax laws and to reach out to the local Crypto community to learn more.