It was the ship that “God himself could not sink,” a technological marvel of its time and a veritable mountain of steel, yet it sank in less than three hours. A random iceberg that drifted into the ship’s path tore a 60-meter gash in its hull, causing it to lose balance and go underwater. Theories on who is to blame focus on the captain, Edward John Smith, who wanted to finish his final voyage and retire, which led to his inexplicable rookie mistakes. From that sinking arose a slew of rules and regulations to make sure there is never another Titanic disaster. The crypto world had its own Titanic disaster with Mt. Gox, a crypto exchange captained by Mark Karpeles, a French otaku with a superiority complex who also made rookie mistakes that led to Mt. Gox losing balance and going underwater. Mt. Gox collapse happened on February 7, 2014, when the exchange suspended all trading and filed for bankruptcy after losing approximately 850,000 bitcoins, worth around $450 million at the time, due to theft and security breaches that had been ongoing since 2011.

Denial in the Face of Disaster

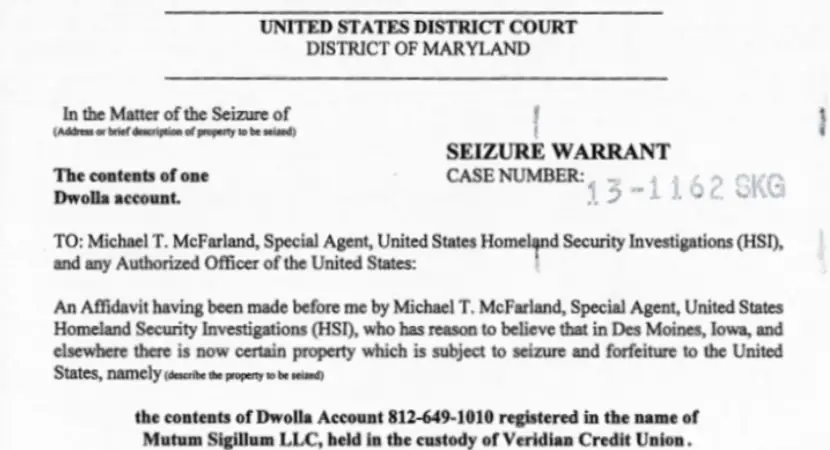

There were plenty of warning signs that the Titanic was about to sink, but the passengers ignored them because they had blind faith that the ship was unsinkable. By the time they realized what was happening, it was too late to avoid their doom. One upside of their blind faith was that they did not panic when it came time to board the lifeboats, of which there weren’t enough for everyone, so that the high-value passengers could peacefully board them first. There were similar warning signs of the Mt. Gox collapse, primarily in the form of withdrawal issues that were obvious to everyone who wanted to look. They were a strong indication that Mt. Gox had balance issues and was about to go underwater. Mt. Gox users reacted in pretty much the same way as Titanic passengers — they were in denial until the worst happened. The first tear in Mt. Gox’s hull came on May 14, 2013, when some of its users received an email from Mt. Gox’s payment processor informing them that their bank transfers to Mt. Gox would not be completed. At Dwolla, the Iowa-based company that sent the email, the Department of Homeland Security agents had shown up with a warrant and were busy gathering information on their users and transactions. The warrant authorized DHS to seize all funds in Mt. Gox’s account, because it belonged to an illegal money-transmitting business. Mt. Gox issued a press release stating that it had not been informed of the seizure, the court order, or the warrant. ArsTechnica got a copy of the DHS warrant, which laid out what had happened.

When Mt. Gox's lost access to its US clients, it lost a lot of its liquidity

Mt. Gox’s account at Dwolla, registered under the business name Mutum Sigillum LLC, which translates from Latin as “silent statuette,” violated 18 USC 1960, “Prohibition of unlicensed money transmitting businesses,” because Mark Karpeles signed a form stating that he wouldn’t use it for money services when signing up for a Dwolla account, and he obviously breached that promise. That was trivial to prove for the court: an informant for the DHS made a Dwolla and a Mt. Gox account, funded his Dwolla account with USD, sent the funds to Mt. Gox, traded BTC, and withdrew the money back to Dwolla, confirming that Mt. Gox served as a money transmitter. That was enough cause to shut down Mutum Sigillum LLC and thus leave Mt. Gox without a way to service US clients. The seizure came a few months after the US Department of Treasury issued guidance document FIN-2013-G001 that clarified that laws and regulations covering fiat currencies also apply to virtual currencies. It also said that users are exempt, but exchangers or administrators of virtual currencies who accept and transmit convertible units of virtual currencies are not.

When Government Inquiries Happen, the Party’s Over

After the Titanic sank, there were inquiries into what happened and how to prevent it from ever happening again. The gist of their findings was that there was no consistency in procedures, because there were no clear laws and rules on what to do in a crisis on the open sea. When the crew of the Titanic fired red flares to indicate distress, nearby ships thought that they were launching them at a party. When they sent out distress calls, the nearest ship’s radio officer couldn’t receive them because he turned his radio off before bed. Those findings set the stage for a stricter and more comprehensive set of naval crisis management procedures. Something similar will happen with Mt. Gox, the collapse of which will make Japan introduce the most rigid cryptocurrency laws and regulations on the planet.

Large systems can be unusually resilient to collapse up to a point, after which they collapse instantly

After the Dwolla raid, Mt. Gox tried to change course and align itself with the new regulations by issuing a press release on May 30, in which it notified all its customers that they will have to verify their identity for deposits and withdrawals in USD but not for Bitcoin. That did not help Mt. Gox prevent another raid and more US government scrutiny. On June 19, another search warrant and court order were executed, seizing a total of $5 million of Mt. Gox’s money from its banking accounts in the US. With that, Mt. Gox became unable to send USD to its US clients’ accounts, and the price of BTC on Mt. Gox rose to account for the estimated 10% chance that no withdrawals would be possible at all. The seizures were later linked to Silk Road, with a US government statement revealing that Mt. Gox was moving about $60 million a month into Silk Road.

Those concerns were validated the next day, when Mt. Gox issued a press release stating that the exchange will stop processing USD withdrawals for two weeks. On July 4, Mt. Gox resumed with USD withdrawals as promised, but many people complained that the processing time was slow. Forum commentators gathered their withdrawal reports and discovered that withdrawal delays began around June 12 and that it took Mt. Gox about 2 months to clear 1 week of withdrawal requests. Mt. Gox support tickets stated that the exchange could only complete 10 SWIFT transfers a day in USD with their new banking partner. At that point, panic started to set in, and everyone realized that Mt. Gox collapse was imminent. But, there were still profits to be made trading on Mt. Gox as it was the biggest exchange of its kind. When should one abandon a sinking ship full of valuables that can be looted?

Bizarre Behaviors When the New Reality Sets In

As the Titanic was sinking, the 8-member orchestra kept playing on the deck to soothe the passengers’ fears, with some saying the piece was called “Nearer, My God, to Thee.” That music served as their swan song because there was no room for them in the lifeboats, and they all quickly succumbed to icy waters. There is no evidence that anyone engaged in rearranging the deck chairs while the ship was sinking, with the phrase most likely appearing sometime in the 1970s in Canadian media. Still, that behavior and that phrase are valuable reminders of how people can go into a state of shock and engage in bizarre or meaningless behaviors when faced with the disaster of their lives. There are parallels to this in the crypto world, with people losing their minds over a rugpull to the point of taking their life. Owners of crypto exchanges can act the same way, and Mark indeed announced upgrades and improvements to Mt. Gox while its users couldn’t withdraw their money.

“Drop the chairs, we’re about to launch Midas”

August 6, Mt. Gox announced a new trading engine, dubbed “Midas,” that was allegedly capable of doing 500,000 trades a second compared to the old one’s 37, but there was no deployment date, which took the wind out of that announcement. September 16, Mt. Gox announced a $5.3 million loss due to a problem with its potential partner, Coinlab, alleging that it withheld that much in user funds of people who signed up with Mt. Gox through Coinlab. The $10.3 million combined loss wiped out all Mt. Gox USD revenue earned from launch and dipped into revenue made in other currencies. On September 21, users gathered their most recent reports on USD withdrawal times and estimated that they range from 2 weeks to 22 months. Rumors started swirling that the exchange is insolvent, with an alleged Mt. Gox employee stating that it will collapse within two months. November 6, Wired published an article titled “The Rise and Fall of the World’s Largest Bitcoin Exchange” that seemed to confirm those rumors.

The article detailed the goings-on at Mt. Gox, and praised Mark Karpeles’ skills, stating that he is an expert in “Linux Servers, Network Security, PHP, Bash, C, C++, Posix API, ASM.” Now we know that, even if he were an expert, those skills couldn’t replace a competent development team that he didn’t want to hire. By late November, Bitcoin soared to $1,000 for the first time in history, but Mt. Gox’s market share fell to 14% as its customers were abandoning ship en masse and moving to more competent and liquid exchanges. One person who tried to keep people on board was Roger Ver, a famous Bitcoin advocate, who filmed a video from inside Mt. Gox offices and claimed that he saw Mark log into his Japanese bank account loaded with money, making some people hopeful that Mt. Gox can pull through. Coinapult CEO, Erik Voorhees, also tried to soothe fears by saying that the DHS seizure of Mt. Gox accounts is a good thing, claiming that it proves Bitcoin is the superior payment system compared to fiat.

Mt. Gox Support Staff Abandons Ship As Mark Shifts the Blame

January 13, 2014, nobody could ignore the signs of Mt. Gox collapse any more. Customers’ support tickets were no longer being resolved, because Mt. Gox started firing its customer support staff, which said so in their replies to customers. This was discussed on Reddit at length, with some Redditors dismissing those reports as unfounded rumors, but then Mt. Gox started having issues with processing Bitcoin withdrawals. In the Jan 25–Feb 4 period, there were 41,390 failed Bitcoin transactions where the money left Mt. Gox but never arrived at customers’ wallets. The exchange blamed the failed withdrawals on a Bitcoin bug called “transaction malleability,” which was fixed in the 0.8 version of Bitcoin mining software but which Mt. Gox refused to adopt.

On February 7, the exchange disabled BTC withdrawals entirely, which is the date mentioned in bankruptcy documents as the exact date when the exchange became insolvent. Transaction malleability basically means that Bitcoin transactions can be valid but appear invalid, causing the sender to freak out and repeat the transaction. We now know that Mark used other funds, including his personal funds, to cover up missing and stolen user funds, so he instantly refunded users who didn’t have to be refunded, effectively doubling their Bitcoin withdrawals. Repeat enough times and there goes roughly $500 million in Bitcoin belonging to users. On February 13, Mark had an email interview with Forbes, blaming the failed withdrawals squarely on Bitcoin. In Mark’s words, Mt. Gox used an implementation of the Bitcoin client that was created in 2011, which was not suited for such a volume of transactions, while also blaming the transaction malleability problem. Two users protested in front of Mt. Gox offices around that time asking for their money, but Mark refused to acknowledge them, instead shutting Mt. Gox offices down and moving into a virtual office on February 19, citing fears of assault and prompting Bitcoin price on Mt. Gox to fall to $250 compared to Coinbase’s $630.

The perfect depiction of chasing a sunk cost

One Final Attempt To Stay Afloat

Despite Mt. Gox being insolvent, some people at the exchange were still huffing hopium. On February 24, Mt. Gox released “Crisis Strategy Draft,” an 11-page document detailing four steps to save Mt. Gox:

- Reduce liabilities by bringing in partners

- Shut down the exchange for 1 month

- Revamp the branding and social media channels

- Redesign the service, including the codebase

But, there was no way to recover. Mt. Gox was amidst a full-blown liquidity crisis to the point nobody called it “Mt. Gox” anymore; it became “Empty Gox.” Even if Mt. Gox had managed to restore its banking services to full capacity and deploy Midas, users would have commenced a bank rush as soon as it opened, instantly draining any remaining funds. February 25, the Mt. Gox exchange was shut down for good and people were left to sift through the flotsam in hopes of salvaging whatever tidbits remained. To add insult to injury, Mark Karpeles and Mt. Gox were also unceremoniously booted from the Bitcoin Foundation board. Japanese chief cabinet secretary, Yoshihide Suga, announced a full government investigation involving the Finance Ministry and the police into Mt. Gox’s collapse, with the most likely outcome being strict regulation of cryptocurrencies. A few days later (March 4), Nikkei reported that BTC will be taxed and that neither banks nor securities firms will be allowed to handle BTC. To date, Japan remains the country with the strictest cryptocurrency laws, with Mark later trying to open another cryptocurrency exchange in Japan but being repeatedly denied, much to his chagrin.

Mark finally showed some humility after the exchange collapsed

Internal Leak Shows the Scale of the Disaster

More and more information about Mt. Gox started leaking into the public. March 3, 2014, the biggest leak of Mt. Gox internal data happened from Mark’s Reddit account and his personal blog by a hacker named nanashi (meaning “anonymous” in Japanese), who claimed to be a Russian residing in Serbia. Mark confirmed the authenticity of the leak, which included Mt. Gox customer balances, withdrawal limits, login data, and Mt. Gox source code. It showed that Mark Karpeles was by far the worst trader on Mt. Gox, being 219,000 BTC in the red. The internal leak showed a discrepancy between what Mark stated in his press conference, where he announced the exchange shutdown, and the internal data. Mark said in the press conference that 850,000 BTC were stolen by thieves (750,000 belonging to users and 100,000 belonging to Mt. Gox), worth $450 million at the time. Hackers found evidence that Mt. Gox had 951,116 BTC total, accusing Mark of stealing the missing 101,116, but that discrepancy is not conclusive proof of theft. The 951,000 BTC could be Mt. Gox’s internal numbers that needn’t reflect their actual funds.

Mt. Gox Repayment: $3 out of $5.8 Billion Returned

Given enough time and effort, all Bitcoin transactions can be traced. That happened with the stolen and misplaced Mt. Gox Bitcoin as well, with stubborn investigators managing to find the hackers that repeatedly stole BTC from Mt. Gox’s wallets and repay their rightful owners, though it took an entire decade. Mt. Gox repayment began in July 2024, with approximately 50,186 BTC (worth around $3 billion at the time) already distributed, primarily through exchanges like Kraken and Bitbank, but there are still around 90,344 BTC (roughly $5.8 billion) held in Mt. Gox-linked wallets. The final deadline for repayments has been postponed to October 31, 2025, because, according to Mt. Gox trustee Nobuaki Kobayashi, people haven't completed the necessary repayment procedures.

Mt. Gox Hack Attacks Were Unstoppable Despite Security Upgrades

As Mark Zuckerberg famously said in his 2018 Brussels hearing when Facebook (now called Meta) was in the spotlight, “Security is not a problem that you ever fully solve.” That was true for Mt. Gox as well, seeing how it was apparently under constant hack attacks even after it made some serious security upgrades, such as adopting Yubikey hardware tokens. Mt. Gox hack problems began in June 2011, when 25,000 Bitcoins (worth around $400,000 at the time) were stolen from 478 user accounts, starting a running breach that went undetected for years until in February 2014 Mt. Gox suddenly suspended withdrawals, and it was later revealed that 850,000 Bitcoins disappeared from the exchange, which was about 6% of the total BTC in circulation at the time. The company soon filed for bankruptcy.

Can I Get My Bitcoin Back From Mt. Gox?

A single deck chair from the Titanic is now worth at least $100,000, provided you can dive to the bottom of the ocean and recover it. There is a parallel there with the Bitcoin lost due to the Mt. Gox collapse, which is worth about the same in 2025. There was an attempt by the Japanese government to salvage as many Mt. Gox bitcoins as possible and return them to their rightful owners, which is possible thanks to crypto forensics and crypto recovery methods constantly evolving, so if you ask yourself can I get my Bitcoin back from Mt. Gox? The period in which people could file proofs of their claim for lost Mt. Gox Bitcoin ended on October 22, 2018. This means that users can no longer file proofs through the online claim filing system. In case you have filed the proof in time and you have any questions, you can go ahead and file an inquiry on the FAQ page.

PlasBit’s Fight for a Fairer Crypto World

Many Titanic passengers died due to being second-class citizens who had to be locked away at lower levels, in part because it was believed that segregation stopped transmittable diseases. They could see and feel what was happening with the ship, but nobody cared about their well-being or their point of view. They put their lives in the hands of the people who treated them like filthy rats, because they were desperate and felt that they had no choice. I am sure that many Mt. Gox users felt the same way and thought that trading on Mt. Gox is their only chance to ever get rich and have a happy, fulfilled life. Instead, they lost most or all of what they had invested into the exchange. That kind of inhuman treatment is still present in the crypto ecosystem, with some developers and exchange owners exuding disdain for their audience and their customers. I think that’s the most reliable warning sign that the project they’re running is doomed to become another Titanic, but nobody knows when it’s going to sink, so it can be tempting to invest in them and try to make some profit. In my point of view, that is a self-defeating strategy, because wealth means nothing without dignity and self-respect, which is why I am thrilled to be working with PlasBit, where I found just that. I had the privilege to peek behind the scenes, meet some of the people running PlasBit, and get a chance to see how they’re running the ship. They answered all my goofy questions and laid all my worries to rest. I feel taken care of and wealthy, but it’s not about the money, it’s about finding sensible people who want to make a difference in the crypto ecosystem and build a lasting legacy. I don’t know where we’re headed, but I like the journey so far and know that we’re not going to let ourselves be another Mt. Gox.